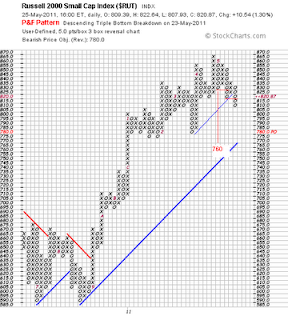

A 'bearish catapult in P&F is basically a triple bottom sell signal followed by a small pull back and then a double bottom sell signal (a triple/double bottom combo!)

If you read the above chart left to right, it can be seen that the price falls, finds support then reverses in to an up column. It then reverses down and finds support at the same level. Then reverses back up and then back down, this time breaking through the previous support. As it breaks support on the third attempt its called a triple bottom sell signal.

In the bearish catapult pattern, this is then followed by a pull back producing a descending top and finally a double bottom sell signal.

And here, on this daily 50x3 H/L P&F on the Dow Jones, we have a bearish catapult pattern! The target given from the top is 11,950 and is active.

While the

short term view on the Dow based on this chart is bearish, one must concede that the overall chart remains bullish because the main bullish support line has not been breached and there are also two shorter term minor bullish lines in place (which i've inserted).

I am of the view that

daily P&F charts are good for showing potential 'bigger picture' trends and reversals but are no good for trading. From 12,850 the Dow had already fallen

350 points before the first confirmed sell signal was given and the catapult pattern was only confirmed at 12,350,

500 points below the top.

The pattern holds until its broken and they need monitoring as they do not always play out (last September was a case in point - see to the bottom left of the chart how the Dow was 'rolling over' very nicely until QE2's announcement gave rise move that (on this 50x3 chart) equated to a (17x50) 850 point move before the next reversal.

And I guess the most obvious failing is that in order for the blue bullish support line to be broken (and a bearish resistance line to be drawn), the Dow has to fall a further 650 points! But the support line does at least confirm the long term trend.

Looking at the 25x3 H/L chart above post today's action, the market touched an intra day high of 5,951, so the 5,950 box got filled (ie the market moved from 5,925-5,950). There remains overhead resistance at 6,000 and I remain of the view that the recent break of support at 5,875 was significant. So despite today's action, the pattern remains more bearish. But the bears need to get the market down on Monday, ideally from this level or from 6,000 at worse. If we get a pump up above 6,025, i'll have to go back to the drawing board.

Looking at the 25x3 H/L chart above post today's action, the market touched an intra day high of 5,951, so the 5,950 box got filled (ie the market moved from 5,925-5,950). There remains overhead resistance at 6,000 and I remain of the view that the recent break of support at 5,875 was significant. So despite today's action, the pattern remains more bearish. But the bears need to get the market down on Monday, ideally from this level or from 6,000 at worse. If we get a pump up above 6,025, i'll have to go back to the drawing board. On the 25x3 chart based on the closing price, the index finished the day at 5,938, so we ignore the intra day high. Today's action has disrupted that nice downward sloping pattern of lower highs. Again, I think that recent move below the horizontal blue line after so much support is significant but the bears need to get back in with a 3 box reversal - a fill of the 5,825 would confirm the short term bearish trend. If it moves higher on Monday/Tues, i'll have to re-assess.

On the 25x3 chart based on the closing price, the index finished the day at 5,938, so we ignore the intra day high. Today's action has disrupted that nice downward sloping pattern of lower highs. Again, I think that recent move below the horizontal blue line after so much support is significant but the bears need to get back in with a 3 box reversal - a fill of the 5,825 would confirm the short term bearish trend. If it moves higher on Monday/Tues, i'll have to re-assess.